CFA, CPA, and MFin: A Comparative Guide

With the growing diversity of finance careers in Malaysia and globally, aspiring professionals often face a critical question: which qualification offers the best return on investment – Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), or a Master of Finance (MFin)?

Navigating this decision requires careful consideration of various factors, including long-term earning potential and the career trajectories that each qualification can provide. Each path offers distinct advantages, shaped by the unique demands of the finance sector.

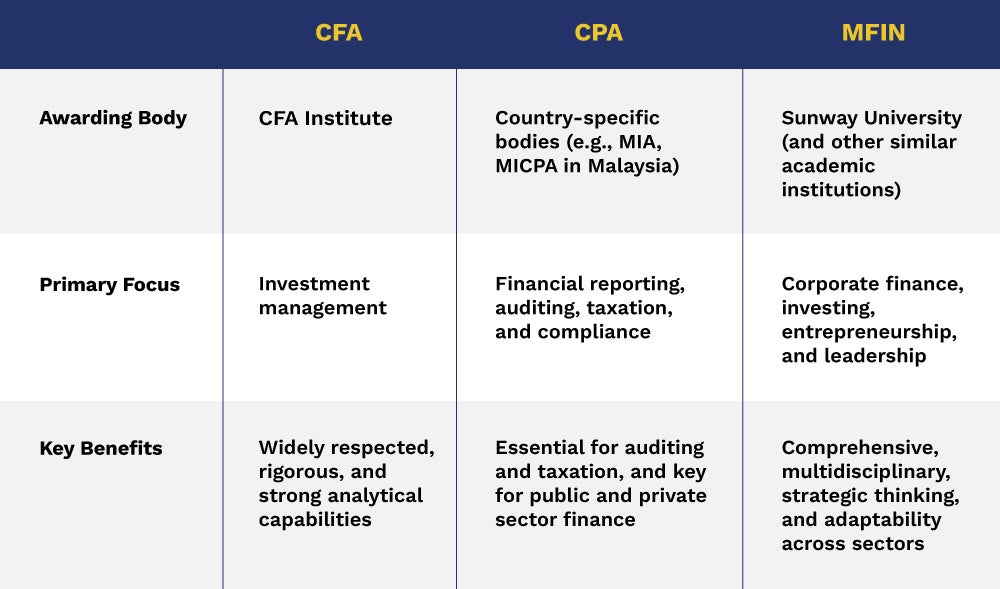

Overview of CFA, CPA, and MFin

While the CFA and CPA are highly specialised qualifications aimed at investment and accounting professionals respectively, the Master in Finance stands out as a broader, multidisciplinary alternative. It’s especially beneficial for those who want a comprehensive understanding of finance and aspire to leadership roles that require strategic thinking, cross-functional knowledge, and adaptability across multiple sectors.

Salary and Career Path Comparison

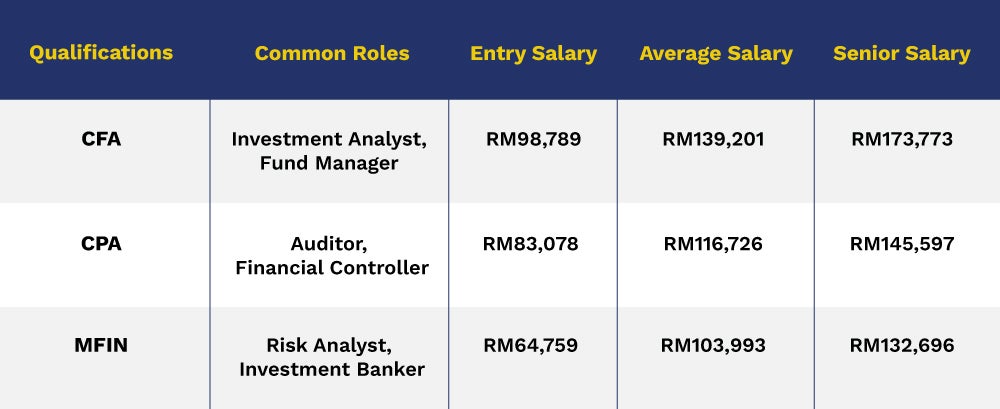

Let’s compare how these qualifications translate into real-world roles, income, and progression. Key considerations include salary benchmarks for finance roles, job market demand, and career progression in finance.

Entry-Level Salaries and Starting Roles

Each qualification begins at a different entry point, both in terms of job function and salary range.

CFA Holders

CFA holders often start as:

- Investment analysts

- Junior portfolio managers

These roles are common in asset management firms and securities research. Starting salaries for CFA roles range from RM60,000 to RM90,000 per year, with the average annual salary standing at RM139,201.

CPA Holders

Typical entry-level positions for CPA-qualified professionals include:

- Audit associates

- Tax consultants (especially in Big 4 firms)

CPA salaries can start at RM80,000 annually. Professionals in KL can earn an average of RM116,726 per year, with steady growth over time.

MFin Holders

Roles that MFin graduates can explore include:

- Corporate finance

- Risk analysis

- Investment banking analyst

Starting salaries for these positions begin at RM60,000, with the average around RM100,000.

Mid to Senior Career Path

CFA holders often transition into senior investment roles – such as portfolio manager, fund strategist, or head of research. These CFA salary roles align closely with high-level investment banking compensation trends.

CPAs, on the other hand, typically progress to roles such as financial controller or audit partner. Their growth is often tied to career milestones, such as licensure tenure and firm leadership.

MFin graduates enjoy flexibility across roles, often advancing into regional finance leadership, strategy, or consulting. For more on how a Master of Finance degree from Sunway University can lead to rewarding career opportunities, visit this article.

Note: The salaries cited in this article are accurate at the time of writing. Figures mentioned above are derived from SalaryExpert’s CFA salary data, SalaryExpert’s CPA salary data, SalaryExpert’s Risk Analyst salary data, and SalaryExpert’s Investment Banker salary data.

Return on Investment and Career Advancement

Which qualification pays off best in the long run? Let’s compare each in terms of return on investment for professional degrees and how they help with advancement opportunities in accounting and finance.

Cost vs. Earning Potential

CFA Holders

Pursuing a CFA charter involves exam fees that can start from USD1,140 per exam (approx. RM5,358). Despite the moderate cost, CFA holders often reach six-figure salaries within 5 to 7 years, particularly in roles with high investment banking compensation.

CPA Holders

For CPA in Malaysia, costs depend on the pathway you choose. In Malaysia, pursuing the CPA qualification via the MICPA–CAANZ Programme typically costs up to RM3,100 per module, excluding items like registration and annual fees.

CPA candidates also must complete a structured practical experience requirement, which adds to the timeline. However, once qualified, CPAs enjoy steady and dependable salary growth over time.

MFin Holders

MFin has a higher tuition fee (depending on the institution), but it includes faculty support, networking, and soft-skill development. It offers structured progression and long-term professional growth in accounting and finance.

MFin prepares students for leadership positions across sectors like corporate finance, fintech, and ESG strategy. Although the cost of qualification versus salary is initially higher, the degree enables broader flexibility in accounting jobs and career transitions, making it ideal for professionals seeking both upward mobility and cross-functional expertise in the evolving finance landscape.

Why Choose a Master of Finance from Sunway University?

While the CFA and CPA are traditional pathways to finance expertise, Sunway University’s Master of Finance offers a compelling alternative for full-time professionals desiring work-life balance alongside career advancement.

The programme’s modern flexibility is a significant advantage, enabling students to seamlessly manage work and studies through a fully online, part-time format. The curriculum is also designed to support both vertical and lateral growth – making it ideal for professionals seeking financial planning career salaries, career progression in finance, or greater flexibility in accounting roles.

Discover how a Master of Finance can help you achieve your career ambitions by downloading the programme guide here, or contact our Education Counsellors to explore your options today.